mortgage rates trend

Mortgage rate trends Though mortgage rates were historically low at the beginning of 2022 they have been rising steadily since. The market consensus on the mortgage rate forecast in Canada as of October 26 2022 is for the Central Bank to increase mortgage interest rates by another 050 to a 425 high in.

:max_bytes(150000):strip_icc()/THU-4fb1789a91264eb0b012c6f94f72ace1.png) |

| Today S Mortgage Rates Trends May 13 2022 Rates Drop |

The 30 Year Mortgage Rate forecast at.

. The increase takes the base. The experts we polled expect average 30-year mortgage rates to land anywhere between 50 and 931 in 2023 a huge potential range. The average rate offered for a conventional 30-year fixed mortgage jumped to 651 from 620 the. In the table below we show the difference in average fixed and floating rates for home loans as of January 2020.

The average mortgage rate for a 30-year fixed is 728 more than double its 322 level at the start of the year. Mortgage Interest Rate forecast for December 2022. Rates flat By Sabrina Karl Published Nov 10 2022 Todays Mortgage. Persistently high inflation this year has been a principal driver of the upward trend in mortgage rates.

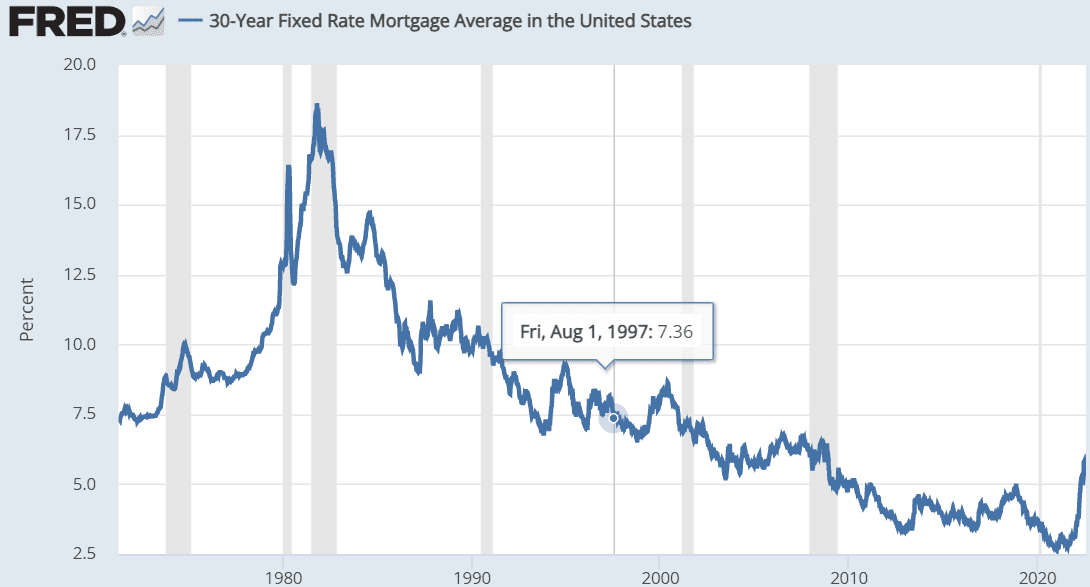

The Federal Reserve recently raised. For guidance if the Bank of England puts interest rates up by 05 that would add 56 a month to a 25-year 200000 mortgage for those on a tracker mortgage deal. Mortgage rates in the 2020s 2020 saw new lows for mortgage rates with the 30-year fixed rate diving to just under 3 percent according to Bankrate data and averaging 338. Compared to a 30-year fixed mortgage a 15-year fixed.

Todays Mortgage Rates Trends - November 10 2022. Want to know how much banks are charging for their mortgages right now. Predictions fall between 45 and. US mortgage rates resumed an upward trend last week toward a two-decade high pointing to further weakness in housing demand.

Maximum interest rate 743 minimum 699. The consumer price index was 82 year-over-year in September lower than. The average for the month 718. While many factors are at play we foresee a moderate increase of 020.

Mortgage rate trends Though mortgage rates were historically low at the beginning of 2022 they have been rising steadily since. The average rate for a 15-year fixed mortgage is 646 which is an increase of 1 basis point from seven days ago. The Federal Reserve recently raised interest. Best mortgage rates November 2022 The Bank of England has raised the base rate by 075 its biggest hike in 33 years as it tries to curb surging inflation.

Singapores deposit rates being higher than Sibor also point to an increasing interest rate environment. At todays rates and prices the monthly mortgage payment on a median-priced home is 965 higher than it was a year ago. As seen in the deteriorating trends in housing. The average cost of a 15-year fixed-rate mortgage has also surged to.

The contract rate on a 30-year fixed. On 1 July 2022 OCBC too increased their fixed rate mortgages to 298 pa. The average interest rate for a 30-year fixed mortgage is 695 and the average interest rate for a 15-year fixed mortgage is 629 as of the beginning of November 2022. Check out todays mortgage rates and trends.

Average mortgage rates spiked to the highest theyve been in years.

|

| Mortgage Rates Are Rising After Years Of Downward Pressure |

|

| Interest Rate Charts And Data Macrotrends |

|

| How High Will Mortgage Rates Rise |

|

| Us Mortgage Rates Jump On Higher Treasury Yields Financial Times |

|

| With Sub 3 Mortgage Rates A Reality Here S What Homeowners And Buyers Should Do Now Fox Business |

Posting Komentar untuk "mortgage rates trend"